Understanding The VA Department Of Taxation: A Comprehensive Guide

Taxes play a crucial role in shaping the economic and social landscape of every state, and Virginia is no exception. The VA Department of Taxation serves as the governing body responsible for administering state tax laws and ensuring compliance among residents and businesses. Whether you're an individual taxpayer, a business owner, or a curious citizen, understanding the VA Department of Taxation is essential for managing your financial responsibilities effectively.

From overseeing income tax filings to regulating sales tax, the VA Department of Taxation touches nearly every aspect of financial life in the state. This article aims to provide a thorough understanding of the department's functions, key programs, and how it impacts individuals and businesses alike. By the end of this guide, you'll have a clear picture of how the department operates and how it affects your daily life.

As we delve into the workings of the VA Department of Taxation, we'll explore its history, responsibilities, and the resources available to taxpayers. Whether you're navigating the complexities of state income tax or seeking assistance with property tax relief, this article will serve as a valuable resource for all your tax-related queries.

- Nicole Scherzinger And Lewis Hamilton A Power Couplersquos Journey Through Love Fame And Success

- Legacy Emanuel Medical Center Emergency Room Your Trusted Healthcare Partner

Table of Contents

- History of the VA Department of Taxation

- Key Responsibilities of the VA Department of Taxation

- Virginia Income Tax: An Overview

- Sales Tax in Virginia

- Property Tax Relief Programs

- Business Tax Regulations

- Resources for Taxpayers

- The Tax Filing Process

- Penalties for Non-Compliance

- The Future of Taxation in Virginia

History of the VA Department of Taxation

Established in 1928, the VA Department of Taxation has a rich history of serving the citizens of Virginia. Originally created to streamline tax collection processes, the department has evolved significantly over the years to address the changing needs of the state's economy and population. Initially, the department focused primarily on property taxes, but as Virginia's economy diversified, so did its responsibilities.

Key Milestones in the Department's History

- 1928: The department was officially established to centralize tax administration.

- 1950s: Introduction of state income tax to support public services and infrastructure development.

- 1980s: Expansion of sales tax to include a broader range of goods and services.

- 2000s: Implementation of digital filing systems to enhance convenience for taxpayers.

Today, the VA Department of Taxation continues to adapt to technological advancements and changing economic conditions, ensuring that its services remain relevant and accessible to all Virginians.

Key Responsibilities of the VA Department of Taxation

The VA Department of Taxation is tasked with several critical responsibilities that directly impact the financial well-being of individuals and businesses in Virginia. These responsibilities include:

- The Worlds Shortest Woman A Remarkable Life And Inspiring Journey

- Plymouth And Brockton Bus Schedule A Comprehensive Guide For Your Journey

Administration of State Taxes

This involves overseeing the collection of various types of taxes, including income tax, sales tax, and property tax. The department ensures that all taxpayers comply with state tax laws and regulations.

Providing Taxpayer Assistance

The department offers a range of resources and services to assist taxpayers in understanding and fulfilling their obligations. This includes helplines, online resources, and in-person assistance at local offices.

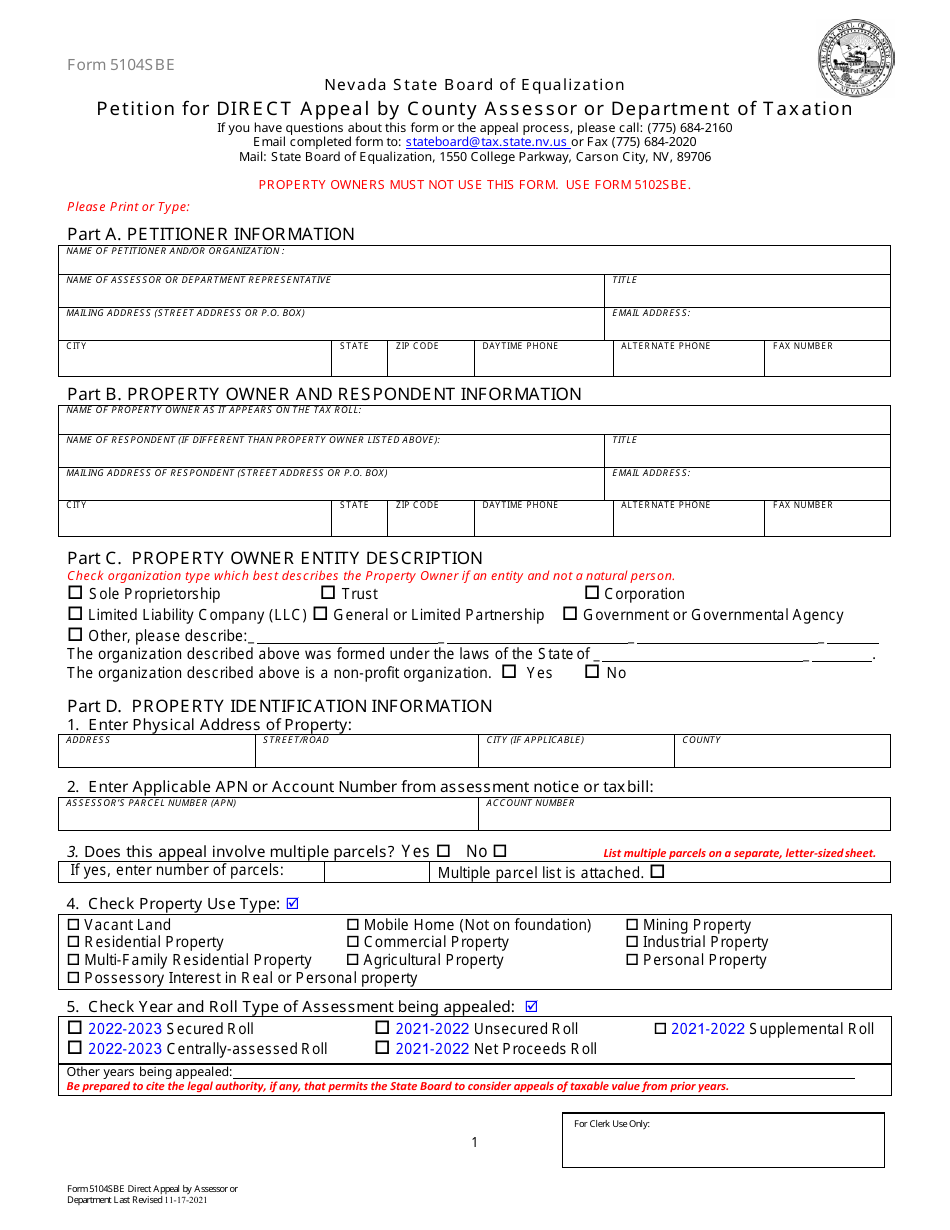

Enforcing Tax Laws

To maintain fairness and integrity in the tax system, the VA Department of Taxation enforces tax laws rigorously. This includes auditing tax returns and imposing penalties for non-compliance.

Virginia Income Tax: An Overview

Virginia imposes a state income tax on all residents, as well as on non-residents who earn income within the state. The income tax system in Virginia is designed to be progressive, with rates varying based on income levels.

Income Tax Rates in Virginia

As of 2023, Virginia's income tax rates range from 2% to 5.75%, depending on the taxpayer's income bracket. The tax brackets are structured to ensure that lower-income individuals pay a smaller percentage of their income compared to higher-income earners.

For example:

- Income up to $3,000 is taxed at 2%.

- Income between $3,001 and $5,000 is taxed at 3%.

- Income above $17,000 is taxed at 5.75%.

It's important for taxpayers to stay informed about any changes in tax rates or brackets, as these can significantly impact their annual tax liabilities.

Sales Tax in Virginia

Sales tax is another significant source of revenue for the state of Virginia. The standard sales tax rate in Virginia is 4.3%, but certain localities may impose additional taxes, bringing the total rate to as high as 6% in some areas.

Exemptions and Incentives

The VA Department of Taxation offers various exemptions and incentives to encourage specific behaviors or support certain industries. For example, certain medical devices and prescription medications are exempt from sales tax, while businesses involved in renewable energy may qualify for tax credits.

Understanding these exemptions and incentives can help individuals and businesses reduce their tax burdens and make informed financial decisions.

Property Tax Relief Programs

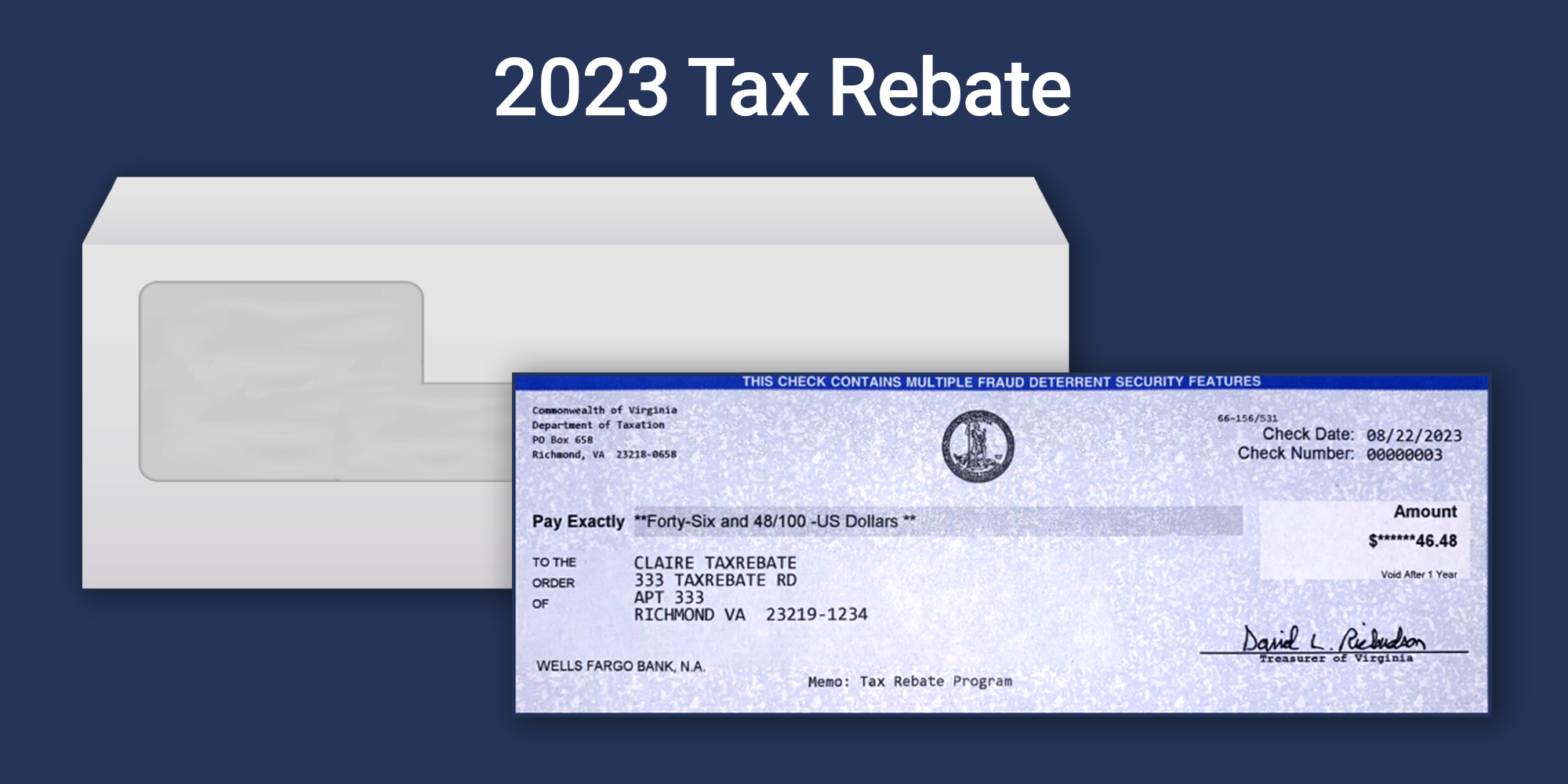

Property taxes are a major concern for homeowners in Virginia. The VA Department of Taxation offers several relief programs to assist eligible taxpayers in managing their property tax obligations.

Who Qualifies for Property Tax Relief?

Eligibility for property tax relief programs varies depending on the program. Common qualifiers include:

- Senior citizens aged 65 and above.

- Disabled individuals who meet specific income criteria.

- Veterans with service-connected disabilities.

These programs aim to ensure that property taxes remain manageable for those who may face financial challenges.

Business Tax Regulations

Businesses operating in Virginia are subject to various taxes, including corporate income tax, sales tax, and employment taxes. The VA Department of Taxation provides guidance and resources to help businesses navigate these complexities.

Corporate Income Tax Rates

Virginia's corporate income tax rate is currently set at 6%. Businesses must file annual tax returns and pay taxes on their net income earned within the state. Additionally, businesses may be eligible for credits and deductions that can reduce their overall tax liability.

Staying compliant with business tax regulations is crucial for avoiding penalties and ensuring smooth operations.

Resources for Taxpayers

The VA Department of Taxation offers a wealth of resources to assist taxpayers in understanding and fulfilling their obligations. These resources include:

Online Filing Tools

Taxpayers can file their state income tax returns electronically through the department's website. This convenient option allows for faster processing times and easier access to tax records.

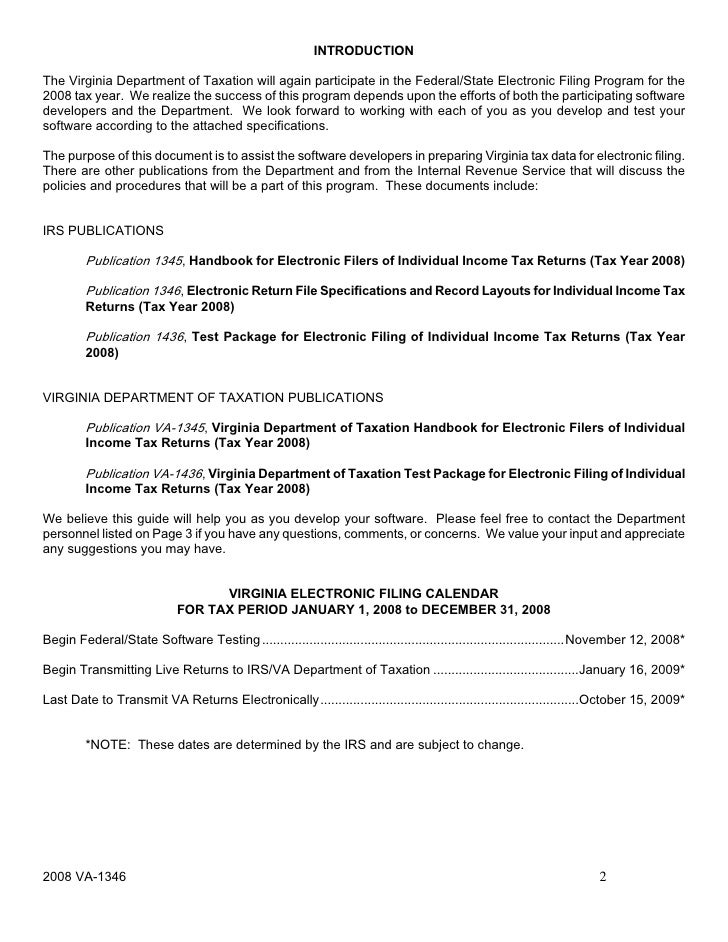

Publications and Guides

The department publishes numerous guides and publications covering a wide range of tax topics. These resources provide detailed information on tax laws, filing procedures, and available exemptions.

By leveraging these resources, taxpayers can ensure that they are well-informed and prepared to meet their tax obligations.

The Tax Filing Process

Filing state income taxes in Virginia is a straightforward process, especially with the availability of digital tools and resources. Here's a step-by-step guide to help you through the filing process:

Step 1: Gather Necessary Documents

Before beginning the filing process, ensure you have all necessary documents, including W-2 forms, 1099 forms, and any other relevant financial records.

Step 2: Choose a Filing Method

You can file your taxes online through the VA Department of Taxation's website or submit a paper return by mail. Online filing is generally faster and more convenient.

Step 3: Review and Submit

Double-check your tax return for accuracy before submitting it. Once submitted, you can track the status of your return online.

Following these steps will help ensure a smooth and error-free filing experience.

Penalties for Non-Compliance

Failing to comply with state tax laws can result in significant penalties. The VA Department of Taxation enforces strict penalties for late filings, underpayments, and other forms of non-compliance.

Common Penalties

- Late filing penalty: 5% of the unpaid tax for each month the return is late, up to a maximum of 25%.

- Late payment penalty: 0.5% of the unpaid tax for each month the payment is late, up to a maximum of 25%.

- Interest charges: Interest accrues on unpaid taxes at a rate determined annually by the department.

Avoiding these penalties is as simple as staying organized and meeting all filing deadlines.

The Future of Taxation in Virginia

As Virginia's economy continues to grow and evolve, the VA Department of Taxation will likely face new challenges and opportunities. Emerging technologies, changing demographics, and shifting economic priorities will all influence the future of taxation in the state.

One potential area of focus is the expansion of digital services to improve accessibility and convenience for taxpayers. Additionally, the department may explore new tax incentives to support emerging industries and promote economic growth.

Staying informed about these developments will be essential for individuals and businesses seeking to navigate the ever-changing landscape of state taxation.

Conclusion

In conclusion, the VA Department of Taxation plays a vital role in shaping the financial landscape of Virginia. From administering state taxes to providing resources and assistance to taxpayers, the department ensures that all residents and businesses fulfill their obligations fairly and efficiently.

By understanding the key responsibilities, programs, and resources offered by the VA Department of Taxation, you can better manage your tax obligations and take advantage of available exemptions and incentives. Remember to stay informed about changes in tax laws and regulations to avoid penalties and make the most of your financial opportunities.

We invite you to share your thoughts and experiences in the comments section below. Additionally, feel free to explore other articles on our site for more insights into financial management and taxation. Together, let's build a brighter financial future for all Virginians.

- The Worlds Shortest Woman A Remarkable Life And Inspiring Journey

- Who Is Randy White Married To Now A Comprehensive Look At His Personal Life

Va Department Of Taxation Va

Va Dept Of Taxation Rebate 2024 Cassie Virgina

Va Dept Of Taxation Eforms