Montana Dept Of Revenue: A Comprehensive Guide To Taxation And Financial Services

The Montana Dept of Revenue plays a crucial role in managing the state's financial systems and ensuring compliance with tax regulations. As a key government agency, it oversees various taxation processes, licensing, and revenue collection activities that directly impact residents and businesses in Montana. Understanding its functions is vital for anyone living or operating a business in the state.

Montana Dept of Revenue is more than just a tax collection agency. It serves as a resource hub for individuals and businesses seeking guidance on financial matters. From property taxes to fuel excise taxes, this department handles a wide range of fiscal responsibilities that contribute to the state's economic stability.

In this article, we will delve into the functions, services, and significance of the Montana Dept of Revenue. Whether you're a resident, business owner, or simply curious about state revenue systems, this guide will provide valuable insights to help you navigate the complexities of Montana's financial landscape.

- Top 50 Restaurants In The World A Culinary Journey Beyond Taste

- Chevy San Diego Kearny Mesa Your Ultimate Guide To Exceptional Service And Quality

Table of Contents

- Overview of Montana Dept of Revenue

- Key Functions of the Montana Dept of Revenue

- Montana Tax Systems and Regulations

- Licensing and Registration Services

- Understanding Property Taxes in Montana

- Fuel Excise Taxes and Regulations

- Resources and Support for Residents and Businesses

- Important Statistics and Data

- Challenges Faced by the Montana Dept of Revenue

- Future Directions and Initiatives

Overview of Montana Dept of Revenue

The Montana Dept of Revenue is a state government agency responsible for managing financial systems and ensuring compliance with tax laws. Established to serve the needs of Montana residents and businesses, this department plays a pivotal role in maintaining the state's economic health. Its primary objectives include tax administration, revenue collection, and providing essential services to the public.

Mission Statement: The Montana Dept of Revenue is committed to fostering a fair and transparent financial system that supports the growth and prosperity of the state. By upholding ethical standards and delivering efficient services, the department aims to build trust and confidence among its constituents.

In addition to its core responsibilities, the department collaborates with other state agencies to address broader financial issues. This collaborative approach ensures a holistic management of Montana's fiscal landscape.

- Chris Farley Dead Body A Comprehensive Look At The Life Legacy And Tragic Passing

- Who Is Khloe Kardashians Father Unveiling The Life And Legacy

Key Functions of the Montana Dept of Revenue

Tax Administration

Tax administration is one of the primary functions of the Montana Dept of Revenue. The department oversees the collection of various taxes, including income tax, sales tax, and excise tax. By implementing robust systems and processes, the department ensures timely and accurate tax collection.

Licensing and Registration

Another critical function of the Montana Dept of Revenue is licensing and registration. The department issues licenses for businesses, vehicles, and other entities operating within the state. These licenses ensure compliance with state regulations and contribute to the state's revenue stream.

Revenue Collection

The department is also responsible for collecting revenue from various sources, such as property taxes, fuel taxes, and other excise taxes. Efficient revenue collection helps fund essential public services, including education, healthcare, and infrastructure development.

Montana Tax Systems and Regulations

Montana's tax systems are designed to be fair and equitable, ensuring that all residents and businesses contribute to the state's financial well-being. The Montana Dept of Revenue administers these systems, providing guidance and support to taxpayers.

- Income Tax: Montana imposes a progressive income tax system, with rates varying based on income levels.

- Sales Tax: While Montana does not have a statewide sales tax, local governments may impose their own sales taxes.

- Excise Tax: Excise taxes are levied on specific goods and services, such as fuel, tobacco, and alcohol.

For more information on Montana's tax systems, refer to the official Montana Dept of Revenue website.

Licensing and Registration Services

Business Licensing

The Montana Dept of Revenue provides licensing services for businesses operating within the state. These licenses ensure compliance with state regulations and contribute to the state's revenue stream. Businesses can apply for licenses through the department's online portal, streamlining the application process.

Vehicle Registration

In addition to business licensing, the department handles vehicle registration services. Residents can register their vehicles online or at local county offices. Proper vehicle registration ensures compliance with state laws and helps fund road maintenance and improvements.

Understanding Property Taxes in Montana

Property taxes are a significant source of revenue for Montana. The Montana Dept of Revenue works closely with local governments to assess property values and determine tax rates. Property owners are required to pay taxes based on the assessed value of their properties.

Key Points:

- Property taxes fund essential public services, such as schools and emergency services.

- Property assessments are conducted annually to ensure accurate tax calculations.

- Residents can appeal property assessments if they believe the valuation is incorrect.

Fuel Excise Taxes and Regulations

Fuel excise taxes are an important revenue source for Montana. The Montana Dept of Revenue collects these taxes from fuel distributors and passes the funds to the state's transportation budget. These funds are used to maintain and improve roads, bridges, and other transportation infrastructure.

Key Regulations:

- Fuel distributors must register with the department and pay excise taxes on all fuel sales.

- Tax rates vary based on fuel type, with higher rates for gasoline compared to diesel.

- Compliance with fuel tax regulations is mandatory for all distributors operating in Montana.

Resources and Support for Residents and Businesses

The Montana Dept of Revenue offers a wide range of resources and support services to assist residents and businesses. These resources include online tools, educational materials, and customer service support.

- Online Tools: The department's website provides access to various online tools, such as tax calculators and license applications.

- Educational Materials: Residents and businesses can access guides and publications that explain tax laws and regulations in detail.

- Customer Service: The department offers phone and email support to address inquiries and resolve issues.

For more information, visit the Montana Dept of Revenue website.

Important Statistics and Data

According to recent data from the Montana Dept of Revenue, the state collected over $2 billion in revenue during the last fiscal year. This revenue was generated from various sources, including income tax, sales tax, and excise taxes. The department also processed over 1 million tax returns, highlighting the scale of its operations.

Key Statistics:

- Property taxes accounted for 40% of the state's total revenue.

- Fuel excise taxes contributed 15% to the transportation budget.

- Business licensing revenue increased by 10% compared to the previous year.

Challenges Faced by the Montana Dept of Revenue

Despite its successes, the Montana Dept of Revenue faces several challenges in fulfilling its responsibilities. These challenges include:

- Technological Limitations: The department is working to modernize its systems to improve efficiency and accuracy.

- Compliance Issues: Ensuring compliance with tax laws and regulations remains a significant challenge.

- Resource Constraints: Limited staffing and budget constraints affect the department's ability to deliver services.

Addressing these challenges requires collaboration with stakeholders and investment in technology and resources.

Future Directions and Initiatives

The Montana Dept of Revenue is committed to enhancing its services and addressing the challenges it faces. Future initiatives include:

- System Modernization: Upgrading technology systems to improve efficiency and accuracy.

- Public Education: Expanding educational programs to increase awareness of tax laws and regulations.

- Customer Service Enhancements: Improving customer service through additional support channels and resources.

These initiatives aim to strengthen the department's ability to serve Montana residents and businesses effectively.

Conclusion

The Montana Dept of Revenue plays a vital role in managing the state's financial systems and ensuring compliance with tax regulations. From tax administration to licensing services, the department provides essential services that contribute to Montana's economic well-being. Understanding its functions and services is crucial for anyone living or operating a business in the state.

Call to Action: We encourage readers to explore the resources provided by the Montana Dept of Revenue and stay informed about tax laws and regulations. Share this article with others who may benefit from the information, and visit the department's website for more details. For further reading, check out our other articles on state revenue systems and financial management.

- Did Lebron James Die Debunking The Rumors And Exploring The Truth

- James Charles Coachella Outfit A Comprehensive Guide To His Iconic Style

1500x500

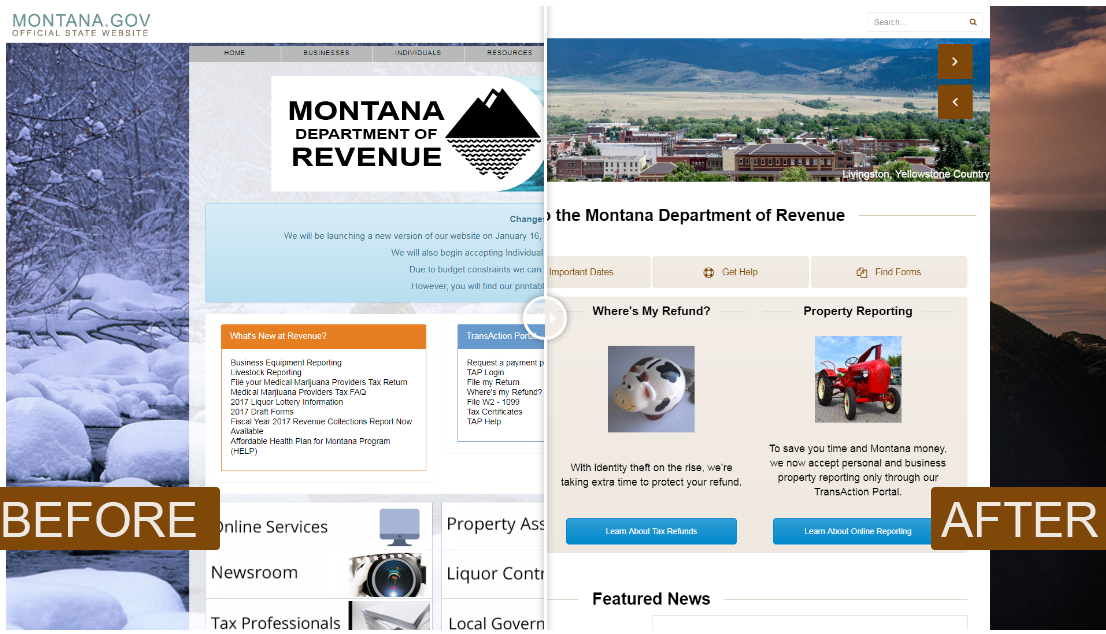

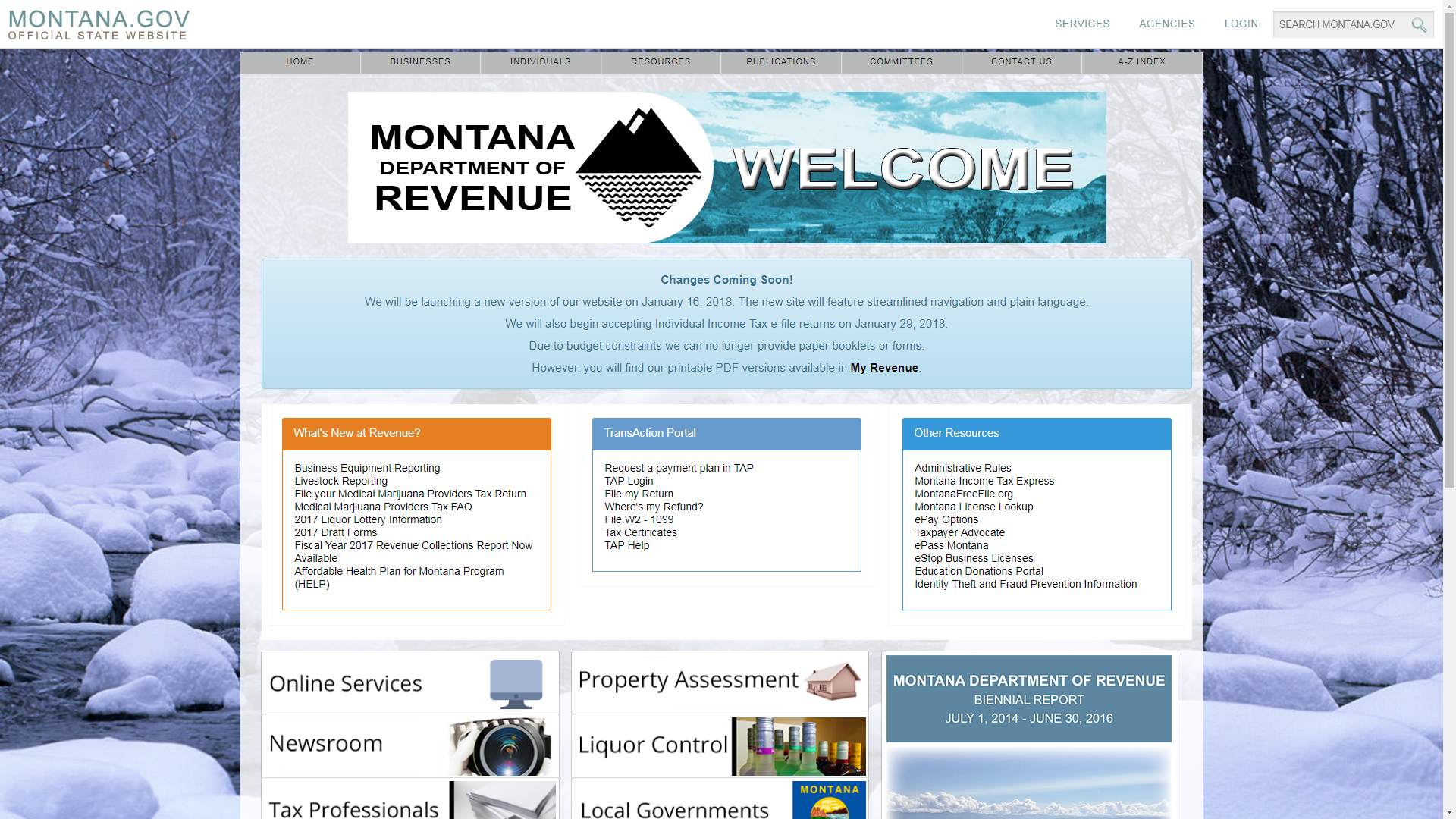

to the New MTRevenue.Gov Montana Department of Revenue

to the New MTRevenue.Gov Montana Department of Revenue