Comprehensive Guide To Chase Debit Customer Service: Expert Tips And Solutions

Managing your finances effectively is crucial, and having access to reliable Chase Debit customer service can make all the difference when you need assistance with your debit card or account. Whether you're dealing with a lost card, unauthorized transactions, or technical issues, understanding how Chase Debit customer service operates is essential for resolving problems quickly and efficiently. This article will provide you with a detailed overview of everything you need to know about Chase Debit customer service.

Chase Debit customer service plays a vital role in ensuring that customers have a smooth banking experience. From answering queries related to your debit card to helping you resolve disputes, Chase provides a range of services to support its users. In today's digital age, it's important to know the channels available for reaching out to Chase and how to maximize these resources for your benefit.

In this comprehensive guide, we'll explore the various aspects of Chase Debit customer service, including contact methods, troubleshooting tips, and best practices for maintaining your account. By the end of this article, you'll be equipped with the knowledge and tools needed to handle any issues that may arise with your Chase Debit card.

- How Old Is Eminem Now Discover The Age Biography And Legacy Of The Iconic Rapper

- Monroe County Fire Wire Your Comprehensive Guide To Safety And Preparedness

Table of Contents

- Introduction to Chase Debit Customer Service

- How to Contact Chase Debit Customer Service

- Common Issues and Solutions

- Chase Debit Security Features

- Online and Mobile Banking Support

- Understanding Chase Debit Card Fees

- Chase Debit for International Travel

- Fraud Protection and Dispute Resolution

- Tips for Effective Communication with Chase

- Conclusion and Call to Action

Introduction to Chase Debit Customer Service

Chase Debit customer service is designed to assist customers with their debit card-related needs. Whether you're a new Chase customer or a long-time user, understanding the scope of services offered can significantly enhance your banking experience. Chase offers a variety of support options, including phone, online, and in-person assistance, making it easier than ever to get the help you need.

Why Choose Chase Debit?

Chase Debit cards are widely accepted and come with numerous benefits, such as fraud protection, cashback options, and easy access to your funds. With a robust customer service network, Chase ensures that its customers receive the support they need to manage their finances effectively.

Key features of Chase Debit customer service include:

- Vermont State Police Blogspot Your Ultimate Guide To Safety And Law Enforcement

- Chris Farley Age At Death Exploring The Life Legacy And Tragic End

- 24/7 support for emergencies

- Personalized assistance for account-related queries

- Access to a wide range of resources for resolving common issues

How to Contact Chase Debit Customer Service

Chase provides multiple ways to reach their customer service team, ensuring that customers can choose the method that best suits their needs. Whether you prefer a phone call, email, or in-person visit, Chase has you covered.

Phone Support

For immediate assistance, you can call Chase Debit customer service at 1-800-935-9935. This number is available 24/7 and connects you directly to a representative who can help with issues such as lost cards, disputed transactions, and account updates.

Online Support

Chase's online platform offers a variety of tools for managing your debit card, including:

- Live chat with customer service representatives

- Access to account statements and transaction history

- Options for reporting lost or stolen cards

Common Issues and Solutions

Many Chase Debit customers encounter similar issues, such as blocked transactions, declined payments, or difficulties with mobile banking. Understanding the most common problems and their solutions can save you time and frustration.

Blocked Transactions

If your Chase Debit card is blocked, it could be due to suspicious activity or a security measure. To resolve this, contact customer service and verify your identity to unblock your card.

Declined Payments

Payments may be declined for various reasons, including insufficient funds, incorrect PIN entry, or network issues. Check your account balance and ensure that your card is active before retrying the transaction.

Chase Debit Security Features

Security is a top priority for Chase, and their debit cards come equipped with advanced features to protect your financial information. Understanding these features can help you safeguard your account and prevent unauthorized access.

Chip Technology

Chase Debit cards use chip technology to enhance security during transactions. This technology generates a unique code for each purchase, making it harder for fraudsters to replicate your card information.

Mobile Alerts

Sign up for mobile alerts to receive notifications about suspicious activity or large transactions. This allows you to take immediate action if you notice any unauthorized charges on your account.

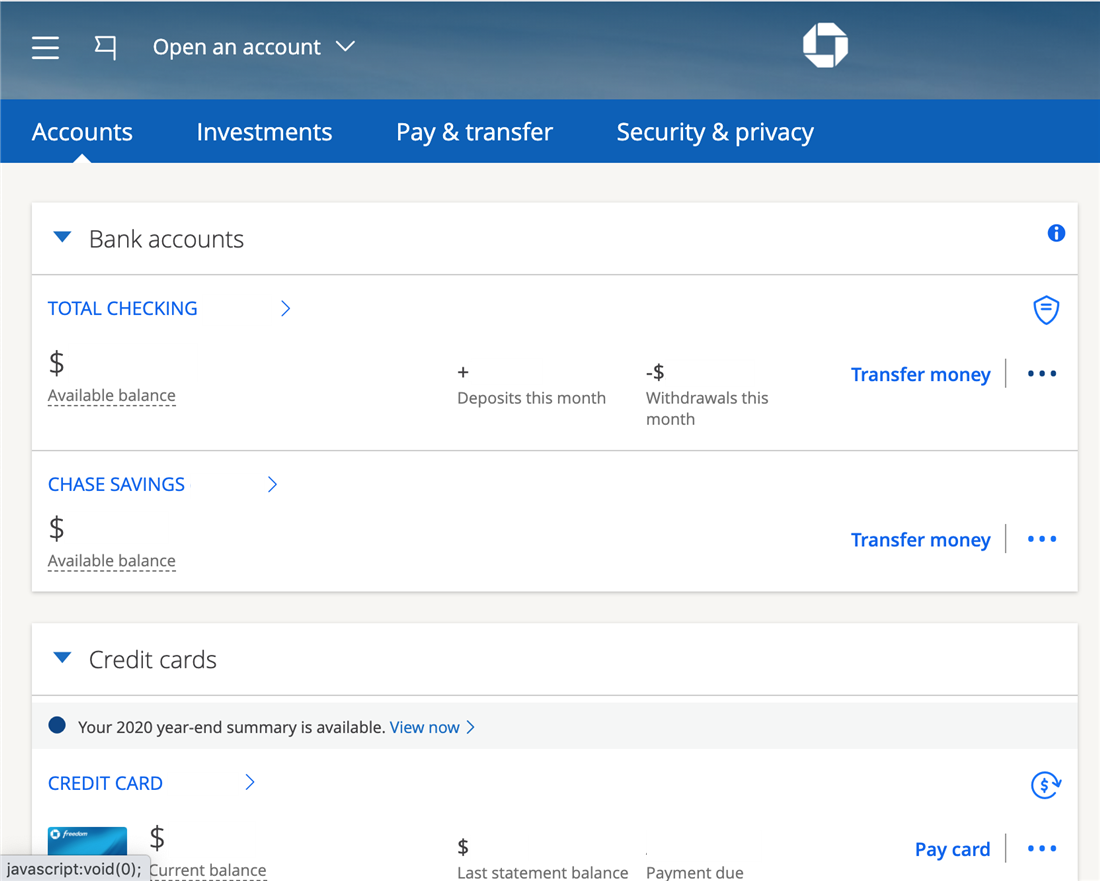

Online and Mobile Banking Support

Chase offers robust online and mobile banking platforms that make managing your finances convenient and efficient. With features like bill pay, account transfers, and transaction tracking, you can handle most banking tasks from the comfort of your home.

Mobile App Features

The Chase Mobile app provides a range of tools for managing your debit card, including:

- Real-time transaction updates

- Options for freezing or unfreezing your card

- Access to customer service chat support

Understanding Chase Debit Card Fees

While Chase Debit cards offer numerous benefits, it's important to be aware of any associated fees. Understanding these fees can help you avoid unnecessary charges and make the most of your card.

ATM Withdrawal Fees

Chase does not charge fees for using their ATMs, but you may incur fees when using non-Chase ATMs. To avoid these charges, plan your withdrawals at Chase-branded locations whenever possible.

Foreign Transaction Fees

If you use your Chase Debit card for international transactions, you may be subject to foreign transaction fees. These fees typically range from 1% to 3% of the transaction amount, depending on the currency exchange rate.

Chase Debit for International Travel

Traveling abroad with your Chase Debit card can be convenient, but it's important to take precautions to ensure a smooth experience. Notify Chase of your travel plans in advance to avoid any disruptions in service.

Pre-Travel Tips

Before you travel, consider the following:

- Inform Chase about your travel dates and destinations

- Check the exchange rates and fees for international transactions

- Carry backup payment methods in case of emergencies

Fraud Protection and Dispute Resolution

Chase offers comprehensive fraud protection for its debit card users, ensuring that your financial information remains secure. In the event of unauthorized transactions, Chase provides a straightforward process for resolving disputes.

Dispute Resolution Process

To report fraudulent activity on your Chase Debit card:

- Contact Chase customer service immediately

- Provide details about the disputed transactions

- Follow up with any required documentation

Tips for Effective Communication with Chase

Communicating effectively with Chase Debit customer service can make all the difference when seeking assistance. Follow these tips to ensure a positive experience:

Prepare for Your Call

Before contacting Chase, gather the following information:

- Your account number and debit card details

- Specific details about the issue you're experiencing

- Any relevant documentation or transaction receipts

Stay Calm and Polite

Approach your conversation with Chase customer service with patience and professionalism. Clearly explain your issue and provide any necessary details to help the representative assist you more effectively.

Conclusion and Call to Action

In conclusion, Chase Debit customer service offers a wide range of resources and support options to help you manage your finances effectively. By understanding the services available and following best practices for communication, you can resolve issues quickly and maintain a secure banking experience.

We encourage you to share this article with others who may benefit from the information provided. If you have any questions or feedback, feel free to leave a comment below. Additionally, explore our other articles for more tips and insights on personal finance management.

For further reading, refer to the following sources:

- How Old Is Jz A Comprehensive Guide To Jayzs Age And Legacy

- How Old Is Mike Pompeo A Comprehensive Guide To His Age Biography And Legacy

Chase Debit Milo Kowalski

How to activate Chase Debit card online? and Offline)

How to Replace Your Chase Debit Card Fast