Travis County Texas Property Tax Records: A Comprehensive Guide

Travis County Texas property tax records are essential documents that provide valuable information about property ownership, valuation, and taxation. Whether you're a homeowner, investor, or researcher, understanding these records is crucial for making informed decisions. This article will delve into the intricacies of property tax records in Travis County, Texas, and provide you with actionable insights.

Property taxes play a significant role in local government funding, and having access to accurate and up-to-date records is vital. In Travis County, Texas, the property tax system is designed to ensure transparency and fairness for all property owners. This guide will explore the various aspects of property tax records, including how they are assessed, where to find them, and how to interpret the data.

By the end of this article, you will have a clear understanding of Travis County Texas property tax records and how they can benefit you. Let's dive in and explore the details.

- Natasha Richardson Movies List A Comprehensive Guide To Her Iconic Performances

- Comprehensive Guide To Msg Seating Chart For Concerts

Table of Contents

- Introduction to Property Tax Records

- Overview of Travis County Texas Property Tax System

- How to Search for Travis County Texas Property Tax Records

- Understanding Property Tax Records

- Property Tax Assessment Process

- Tax Exemptions and Discounts

- Appealing a Property Tax Assessment

- Paying Property Taxes

- Importance of Property Tax Records

- Future Trends in Property Tax Records

- Conclusion

Introduction to Property Tax Records

Property tax records are official documents that contain detailed information about the valuation, ownership, and taxation of properties. In Travis County, Texas, these records are maintained by the local government and are accessible to the public. Understanding how these records are created and maintained is essential for anyone involved in real estate transactions or property management.

Why Are Property Tax Records Important?

Property tax records serve multiple purposes, including:

- Providing transparency in property valuation

- Assisting homeowners in understanding their tax obligations

- Supporting real estate professionals in conducting due diligence

- Enabling researchers to analyze property trends

Overview of Travis County Texas Property Tax System

The Travis County Texas property tax system is administered by the Travis Central Appraisal District (TCAD). TCAD is responsible for assessing property values, maintaining records, and ensuring compliance with state and local regulations. Property owners in Travis County are required to pay taxes based on the assessed value of their properties.

- Ben Amp Jerrys Rocky Road The Ultimate Guide To This Beloved Ice Cream Flavor

- How Far Is Lake George From Me A Comprehensive Guide To Exploring This Scenic Destination

Key Players in the Property Tax System

- Travis Central Appraisal District (TCAD)

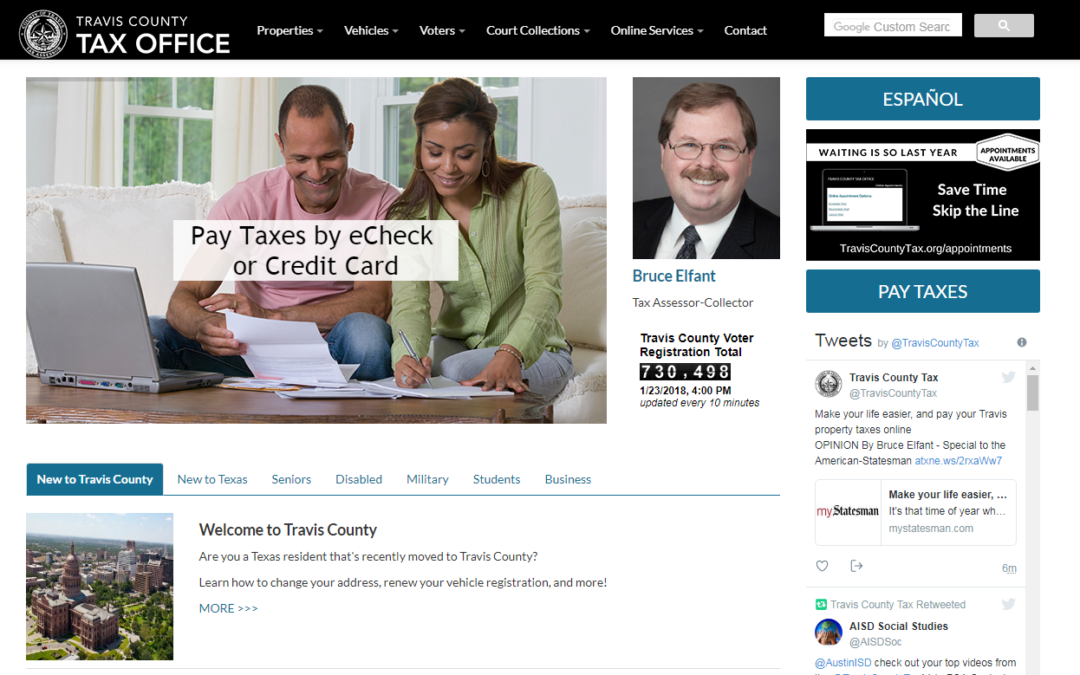

- Travis County Tax Office

- Local municipalities and school districts

How to Search for Travis County Texas Property Tax Records

Accessing Travis County Texas property tax records is straightforward, thanks to the digital tools provided by the Travis Central Appraisal District. Property owners and researchers can search for records online using the TCAD website or visit the physical office for in-person assistance.

Steps to Search for Property Tax Records Online

- Visit the Travis Central Appraisal District website

- Enter the property address or owner name in the search bar

- Review the property details, including assessed value and tax history

Understanding Property Tax Records

Property tax records contain a wealth of information that can be overwhelming for first-time users. To make sense of these records, it's important to understand the key components and terminology used in the documentation.

Components of Property Tax Records

- Property address and legal description

- Assessed value and market value

- Current and past tax payments

- Exemptions and discounts

Property Tax Assessment Process

The property tax assessment process in Travis County involves several steps, including data collection, property valuation, and final assessment. The Travis Central Appraisal District uses a combination of market analysis and property inspections to determine the assessed value of each property.

Factors Affecting Property Tax Assessment

- Property size and location

- Improvements and renovations

- Market conditions and demand

Tax Exemptions and Discounts

Property owners in Travis County may qualify for various tax exemptions and discounts, which can significantly reduce their tax burden. These exemptions are designed to benefit specific groups, such as seniors, veterans, and low-income families.

Common Tax Exemptions in Travis County

- Homestead exemption

- Over-65 exemption

- Disability exemption

Appealing a Property Tax Assessment

If a property owner disagrees with the assessed value of their property, they have the right to appeal the decision. The appeal process involves submitting a formal request to the Travis Central Appraisal District and providing evidence to support the claim.

Steps to Appeal a Property Tax Assessment

- Review the assessed value and identify discrepancies

- Gather evidence, such as comparable property values

- Submit an appeal request to TCAD within the specified timeframe

Paying Property Taxes

Property taxes in Travis County are due annually, and property owners have several options for paying their taxes. Payments can be made online, by mail, or in person at the Travis County Tax Office. Late payments may result in penalties and interest charges.

Payment Options for Property Taxes

- Online payment through the Travis County Tax Office website

- Mail-in payment with a check or money order

- In-person payment at the Travis County Tax Office

Importance of Property Tax Records

Property tax records are not only important for tax purposes but also serve as a valuable resource for real estate professionals, researchers, and property owners. These records provide insights into property trends, market conditions, and economic indicators.

Benefits of Accessing Property Tax Records

- Improved decision-making for real estate transactions

- Increased transparency in property valuation

- Support for economic research and analysis

Future Trends in Property Tax Records

As technology continues to evolve, the way property tax records are managed and accessed is likely to change. Advances in data analytics, artificial intelligence, and blockchain technology may revolutionize the property tax system in Travis County and beyond.

Potential Innovations in Property Tax Records

- Enhanced data analytics for property valuation

- Blockchain-based property records for improved security

- AI-powered tools for faster and more accurate assessments

Conclusion

Travis County Texas property tax records are a vital component of the local property tax system. By understanding how these records are created, maintained, and accessed, property owners and researchers can make informed decisions about real estate transactions and tax obligations. We encourage you to explore the resources provided by the Travis Central Appraisal District and take advantage of the available tools and information.

Feel free to leave a comment or share this article with others who may find it useful. For more information on property taxes and related topics, explore our other articles on the website.

Data sources and references:

- Greg Gutfeld Baby News Exploring The Latest Updates And Family Life

- Blood Is Thicker Than Water Full Quote Exploring The Origins And Meaning

Travis County Tax Office Pay Property Taxes Online

Property Tax Loans in Travis County

Travis County Shapefile and Property Data Texas County GIS Data