Understanding The MT Department Of Revenue: A Comprehensive Guide

The Montana Department of Revenue (MT Department of Revenue) is a critical government agency responsible for managing and overseeing various financial and taxation processes within the state. As one of the key pillars of Montana's fiscal system, this department plays a vital role in ensuring compliance with tax laws, collecting revenue, and providing essential services to residents and businesses. Whether you're a taxpayer, business owner, or simply interested in understanding how Montana's financial systems work, this guide will provide you with all the information you need.

Montana's Department of Revenue operates under a framework designed to promote fairness, transparency, and accountability. Its mission is to ensure that all taxpayers contribute their fair share while offering assistance and resources to those who need them. In today's rapidly evolving fiscal landscape, understanding the intricacies of the MT Department of Revenue is more important than ever.

This article will delve into the functions, responsibilities, and processes of the MT Department of Revenue. From tax collection and licensing to property valuation and taxpayer assistance, we'll explore every aspect of this essential agency. By the end of this guide, you'll have a comprehensive understanding of how the MT Department of Revenue impacts your life and the broader Montana community.

- Davis Moore Chevrolet Wichita Ks Your Ultimate Destination For Quality Vehicles And Exceptional Service

- Why Is It Called An Airbnb The Fascinating Story Behind The Name

Table of Contents

- Overview of the MT Department of Revenue

- Key Functions and Responsibilities

- Taxation and Revenue Collection

- Licensing and Registration

- Property Valuation and Assessment

- Taxpayer Assistance and Resources

- Compliance and Tax Laws

- Technology and Digital Initiatives

- Historical Background and Evolution

- Future Plans and Initiatives

Overview of the MT Department of Revenue

What is the MT Department of Revenue?

The Montana Department of Revenue, often referred to as the MT Department of Revenue, is a state agency responsible for administering tax laws, collecting revenue, and ensuring compliance with financial regulations. Established to support the fiscal health of Montana, this department works tirelessly to balance the needs of the state with the obligations of its citizens and businesses.

Structure and Organization

The MT Department of Revenue is structured into several divisions, each focusing on specific areas of fiscal management. These include Tax Collection, Licensing, Property Valuation, and Taxpayer Assistance. By organizing its operations in this manner, the department ensures that all aspects of revenue generation and management are covered effectively.

Key Functions and Responsibilities

The MT Department of Revenue has a wide range of responsibilities that impact both individuals and businesses in Montana. Below are some of the key functions:

- Bo Jackson 40 Yard Dash The Untold Story Of Speed Power And Legacy

- Weehawken Restaurants On The Water A Culinary Experience With Stunning Views

- Administering state tax laws

- Collecting various types of taxes, including income, sales, and property taxes

- Providing licensing and registration services for businesses and professionals

- Assisting taxpayers with inquiries and issues related to taxation

Taxation and Revenue Collection

Types of Taxes Managed

The MT Department of Revenue oversees the collection of several types of taxes, including:

- Income Tax: Montana has a progressive income tax system that applies to both individuals and corporations.

- Sales Tax: While Montana does not have a state sales tax, local municipalities may impose their own sales taxes.

- Property Tax: Property taxes are assessed based on the value of real estate and are used to fund local services.

Revenue Collection Process

The revenue collection process involves several steps, from filing tax returns to auditing and enforcement. The MT Department of Revenue ensures that all taxpayers meet their obligations through clear guidelines and support systems. For instance, the department provides online portals for easy submission of tax documents and payment of dues.

Licensing and Registration

Licensing and registration are crucial aspects of the MT Department of Revenue's operations. The department manages the issuance of business licenses, professional certifications, and motor vehicle registrations. By streamlining these processes, the MT Department of Revenue helps businesses and individuals operate efficiently within Montana's legal framework.

Property Valuation and Assessment

How Property is Valued

Property valuation is a critical function of the MT Department of Revenue. The department uses a combination of market analysis, property inspections, and historical data to determine the value of real estate. This valuation is then used to calculate property taxes, ensuring that all property owners contribute fairly to the state's revenue.

Appeal Process

Taxpayers who disagree with their property valuation can file an appeal with the MT Department of Revenue. The department provides clear guidelines and support for this process, ensuring that all parties have a fair opportunity to present their case.

Taxpayer Assistance and Resources

Available Resources

The MT Department of Revenue offers a variety of resources to assist taxpayers, including:

- Online guides and tutorials

- Customer service hotlines

- In-person assistance at local offices

Support for Small Businesses

Recognizing the unique challenges faced by small businesses, the MT Department of Revenue provides specialized support and resources. These include tax credits, deductions, and simplified filing processes designed to ease the burden on small business owners.

Compliance and Tax Laws

Understanding Tax Laws

Tax laws in Montana are designed to ensure fairness and transparency in revenue collection. The MT Department of Revenue works closely with state lawmakers to update and refine these laws, ensuring they remain relevant and effective. Staying informed about these laws is crucial for all taxpayers and businesses operating in Montana.

Enforcement and Penalties

The MT Department of Revenue enforces tax laws through audits, penalties, and other enforcement actions. These measures are designed to ensure compliance while offering assistance to those who inadvertently fall short of their obligations.

Technology and Digital Initiatives

Online Services

The MT Department of Revenue has embraced technology to enhance its services. Through its online portal, taxpayers can file returns, pay taxes, and access important resources with ease. This digital transformation has significantly improved the efficiency and accessibility of the department's services.

Future Technological Advancements

Looking ahead, the MT Department of Revenue plans to implement even more advanced technologies, such as artificial intelligence and data analytics, to further enhance its operations. These advancements will allow the department to better serve its constituents and maintain the fiscal health of Montana.

Historical Background and Evolution

The MT Department of Revenue has a rich history that dates back to the early days of Montana's statehood. Over the years, the department has evolved to meet the changing needs of the state and its residents. From manual processes to cutting-edge technology, the MT Department of Revenue continues to adapt and improve its services.

Future Plans and Initiatives

As the fiscal landscape continues to evolve, the MT Department of Revenue is committed to staying ahead of the curve. Future plans include expanding digital services, enhancing taxpayer education programs, and improving the overall efficiency of its operations. By focusing on innovation and collaboration, the department aims to remain a leader in fiscal management and public service.

Conclusion

The MT Department of Revenue plays a vital role in the fiscal health and well-being of Montana. Through its various functions and initiatives, the department ensures that all taxpayers contribute fairly while providing essential services and resources to those in need. Understanding the MT Department of Revenue is crucial for anyone living or doing business in Montana.

We invite you to explore more articles on our website and share your thoughts in the comments section below. Your feedback helps us improve and provide even more valuable content. Together, we can build a more informed and empowered community.

- Meghan And Lilibet Photo 2024 A Closer Look At Their Heartwarming Moments

- How To Contact Fifth Third Bank Comprehensive Guide To The 5th Third Bank Phone Number

Montana Department of Revenue Helena MT

Contact the Cannabis Control Division Montana Department of Revenue

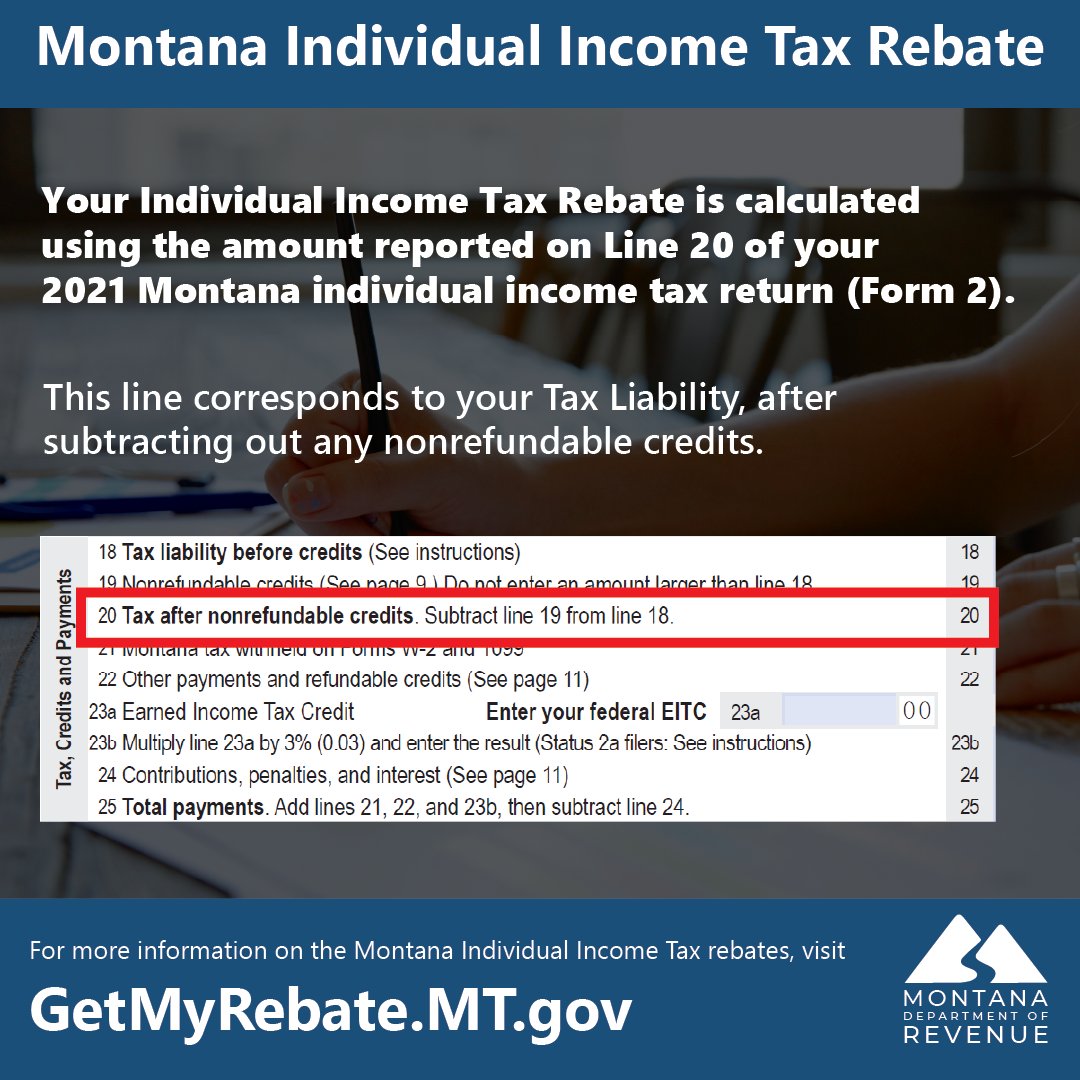

Montana Department of Revenue on Twitter "Your Individual Tax