Understanding The State Of Montana Dept Of Revenue: A Comprehensive Guide

The State of Montana Department of Revenue (MDR) is a critical government agency responsible for managing revenue-related activities within the state. Whether you're a taxpayer, business owner, or simply someone curious about how Montana handles its finances, understanding the MDR's role and operations is essential. This article will delve deep into the functions, services, and significance of this department, providing valuable insights for everyone.

Montana's economy relies heavily on the efficient collection and management of revenue. The Department of Revenue plays a pivotal role in ensuring that these processes run smoothly, supporting both the state's fiscal health and the well-being of its residents. By exploring the various aspects of the MDR, we aim to clarify its functions and highlight its importance in daily life.

As you read through this guide, you'll gain a comprehensive understanding of the State of Montana Dept of Revenue, its responsibilities, and how it impacts individuals and businesses. Let's dive in and uncover the essential details you need to know.

- Cne Venezuela Understanding The National Electoral Council And Its Role

- Illinois Medical License Lookup A Comprehensive Guide To Verifying Healthcare Practitioners

Table of Contents

- Introduction

- Overview of the State of Montana Dept of Revenue

- Key Functions of the Department of Revenue

- Montana's Tax System

- Revenue Collection and Management

- Taxpayer Services and Support

- Business Compliance and Regulations

- Funding Public Projects

- Legal Framework and Compliance

- Future Directions for the Department

Overview of the State of Montana Dept of Revenue

The State of Montana Department of Revenue (MDR) is a government entity that oversees the collection and administration of taxes, licenses, and other revenue streams. Established to ensure the state's financial stability, the MDR plays a crucial role in managing Montana's fiscal policies. Its mission is to provide fair, efficient, and transparent services to taxpayers and businesses.

History of the Department

The MDR has a long history of serving the people of Montana. Since its inception, it has evolved to meet the changing needs of the state's economy and population. Over the years, the department has introduced new programs and technologies to enhance its service delivery and improve taxpayer experiences.

Structure and Leadership

The MDR operates under a structured framework with various divisions and offices. Each division focuses on specific areas such as taxation, licensing, and compliance. The leadership team, including the Director and other senior officials, ensures that the department adheres to its mission and goals.

- Exploring Patrick Fabian Movies And Shows A Comprehensive Guide

- Spencer Cassadine General Hospital The Intriguing Character Who Stole Our Hearts

Key Functions of the Department of Revenue

The State of Montana Dept of Revenue performs several vital functions that contribute to the state's financial health. These functions are designed to support both individual taxpayers and businesses operating within the state.

Tax Administration

One of the primary responsibilities of the MDR is tax administration. This includes the collection of individual and corporate income taxes, sales taxes, and other levies. The department ensures that all taxpayers comply with state laws and regulations.

Licensing and Registration

In addition to tax administration, the MDR handles licensing and registration for various entities. This includes vehicle registration, business licenses, and other permits required for legal operation. Proper licensing ensures that all activities within the state are conducted lawfully.

Montana's Tax System

Montana's tax system is designed to be fair and equitable for all residents and businesses. Understanding how this system works is crucial for anyone living or operating in the state.

Income Tax

Montana imposes a progressive income tax system, with rates varying based on income levels. The MDR is responsible for calculating and collecting these taxes, ensuring that all individuals and corporations pay their fair share.

Sales and Use Tax

While Montana does not have a statewide sales tax, certain localities may impose their own sales taxes. The MDR oversees these taxes and ensures that they are collected and distributed appropriately.

Revenue Collection and Management

Effective revenue collection and management are essential for maintaining the state's financial stability. The State of Montana Dept of Revenue employs various strategies to ensure that revenues are collected efficiently and managed responsibly.

Collection Strategies

The MDR utilizes advanced technologies and systems to streamline the revenue collection process. This includes electronic filing and payment options, making it easier for taxpayers to comply with their obligations.

Management Practices

Once revenues are collected, the MDR ensures that they are allocated appropriately. This includes funding public services, infrastructure projects, and other essential programs that benefit the state's residents.

Taxpayer Services and Support

The State of Montana Dept of Revenue is committed to providing excellent service to taxpayers. This includes offering resources and support to help individuals and businesses navigate the tax system.

Customer Assistance

Taxpayers can access a variety of resources, including online tools, phone support, and in-person assistance. The MDR aims to make the tax process as simple and stress-free as possible.

Educational Programs

To promote tax literacy, the MDR offers educational programs and workshops. These initiatives help taxpayers understand their obligations and take advantage of available credits and deductions.

Business Compliance and Regulations

Businesses operating in Montana must adhere to specific regulations set forth by the State of Montana Dept of Revenue. Compliance with these regulations is crucial for maintaining legal status and avoiding penalties.

Registration Requirements

All businesses must register with the MDR to obtain the necessary licenses and permits. This process ensures that businesses operate within the bounds of the law and contribute to the state's revenue.

Reporting Obligations

Businesses are required to file periodic reports detailing their financial activities. These reports help the MDR monitor compliance and ensure that all businesses fulfill their tax obligations.

Funding Public Projects

The revenues collected by the State of Montana Dept of Revenue are used to fund a wide range of public projects. These projects benefit the state's residents by improving infrastructure, enhancing public services, and supporting economic development.

Infrastructure Development

Revenue from taxes and fees is often allocated to infrastructure projects such as road construction, bridge repairs, and public transportation improvements. These investments are vital for maintaining a modern and efficient transportation network.

Public Services

Additionally, the MDR funds essential public services such as education, healthcare, and public safety. These services contribute to the well-being and quality of life for all residents of Montana.

Legal Framework and Compliance

The State of Montana Dept of Revenue operates within a well-defined legal framework. This framework ensures that all activities conducted by the department comply with state and federal laws.

Compliance Monitoring

The MDR actively monitors compliance with tax laws and regulations. This includes conducting audits and investigations to identify and address any discrepancies or violations.

Enforcement Actions

When necessary, the MDR takes enforcement actions to ensure that all individuals and businesses comply with their obligations. These actions may include penalties, fines, or legal proceedings.

Future Directions for the Department

As the State of Montana continues to grow and evolve, the Department of Revenue must adapt to meet new challenges and opportunities. The future of the MDR will focus on innovation, efficiency, and enhanced services for taxpayers.

Technological Advancements

The MDR is committed to leveraging technology to improve its operations. This includes expanding electronic filing options, enhancing data security, and utilizing analytics to better serve taxpayers.

Community Engagement

Engaging with the community is another priority for the MDR. By fostering open communication and collaboration, the department aims to build trust and ensure that all stakeholders are informed and involved in the decision-making process.

Conclusion

In conclusion, the State of Montana Dept of Revenue plays a vital role in managing the state's finances and supporting its residents. By understanding the functions and responsibilities of the MDR, individuals and businesses can better navigate the tax system and contribute to Montana's economic success.

We encourage you to explore the resources provided by the MDR and take advantage of the services and support available. If you found this guide helpful, please share it with others and consider exploring additional articles on our site. Together, we can promote financial literacy and support the growth and prosperity of Montana.

For more information, please refer to the following sources:

- Montana Department of Revenue Official Website

- IRS Guidelines for State Taxation

- Montana Legislative Reference Materials

- Who Is Nicole Richies Mom A Comprehensive Guide To Her Life Career And Influence

- Where Are The Redwoods A Comprehensive Guide To Exploring The Majestic Giants

1500x500

Dept of Revenue Assessing Property Values in Montana Soon

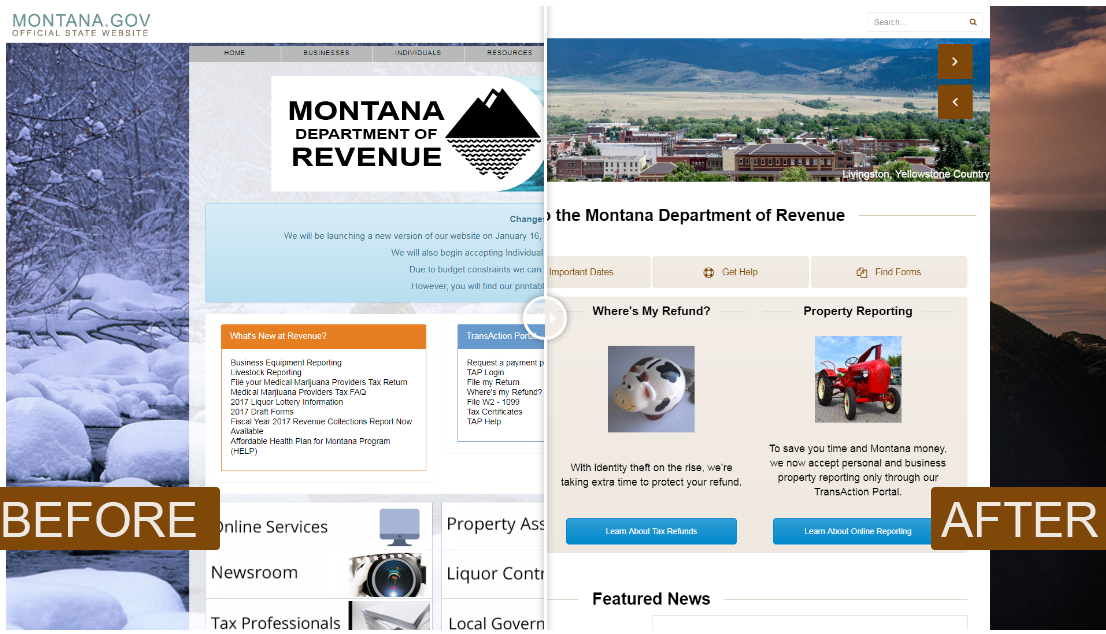

to the New MTRevenue.Gov Montana Department of Revenue